Tippets by Taps - Issue #113

This week we look at hourly worker financial wellness, Ant Financial’s lending platform Huabei, ‘elite’ credit card fees, having kids, marine worms and more. Enjoy!

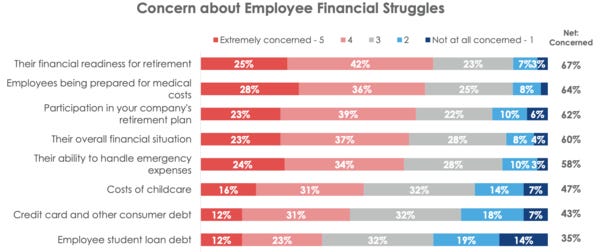

New MassMutual study finds widespread worry among employers about employees' financial woes

According to a new study, 8 in 10 employers say their workers are struggling financially as they wrestle with retirement savings, personal and tuition debt, and medical costs. With over 50% of employees looking for support from their employers when it comes to financial wellness, employers themselves are now looking for new benefits to offer their workers in support of their financial wellness. Now, let’s not be fooled. Given the low unemployment rate and high cost of replacing hourly workers, employers need to do all they can to retain workers. Paying for employees to go back to school, letting employees access their wages before payday, and providing mental health and wellness benefits are just some of the things employers are starting to do. While certainly encouraging, these practices aren’t yet pervasive enough to have widespread impact. Workers are still being mistreated by companies big and small, particularly those in low-wage work and there’s not much they can do about it. More needs to be done on behalf of hourly employees across the board.

Concern is one thing. Doing something about it is entirely different.

A $7 Credit Limit: Jack Ma's Ant Lures Hundreds of Millions of Borrowers

Ant Financial is the largest fintech company in the world. Valued at $150bn, the spinoff from Alibaba has over 1 billion users of its fintech platform that includes payments, lending, insurance, wealth management, credit scoring and more. Huabei, Ant Financial’s micro lending product, is a great example of how the company has come to dominate the market. Originally started as a lending product for customers looking to spend money on Alibaba, it has morphed into the dominant lending platform in China.

These days, Ant’s credit lines are used by hundreds of millions of Chinese citizens to pay for groceries, restaurant checks, clothes and new iPhones from physical and online stores. More than half of Alipay’s 900 million users in China have opened Huabei accounts, according to a former employee and estimates from two of Ant’s shareholders.

Many Huabei users don’t have traditional credit cards and some don’t qualify for bank-issued credit cards. Only about a fifth of China’s population, roughly 278 million people, held credit cards in 2017, according to World Bank data.

Delinquency rates on Huabei’s loans are largely in line with those of credit cards in China. As of June, 1.6% of Huabei’s outstanding loans were more than 30 days past due, while 1.2% were more than 90 days overdue, according to a document for bond investors. That same month, about 1.17% of credit-card loans in China were more than 60 days past due, according to China’s central bank.

Given increased regulatory focus on Ant, the company is likely to push hard to grow its non-Alipay related businesses, as well as push harder to bring non-Chinese users onto the platform. As to questions around whether Ant is still worth $150 billion? Absolutely.

Retailers Don’t Like Paying the Fees for Your Apple Card

The battle between retailers and credit card issuers wages on. The latest instigation: Apple and the Apple Card. Credit card networks and issuers are arguing that customers with ‘elite’ cards (all you Chase Sapphire Reserve and Apple cardholders, that’s you) will spend more in store than regular cardholders so, naturally, stores should pay more fees.

…the card, marketed by Apple and backed by Goldman Sachs Group, is designated “elite,” which allows it to levy significantly higher interchange fees on each swipe or tap…Elite cards impose higher transaction fees to support generous reward programs for their customers…But the cards have long irked retailers. They have no choice but to pay the higher fees for elite plastic if they want to accept any of a network’s credit cards.

And merchants have begun arguing that there are categories, such as groceries, where premium cardholders don’t spend more than regular cardholders. The real beneficiaries of the rewards, they say, are the networks and issuers themselves.

When you consider how credit cards are processed (all cards are processed the same way) and how much money issuers and networks charge in fees for 'elite’ cards as compared to traditional or debit cards, it is really quite unclear why swipe fees are different between card types on the same network. Unfortunately for businesses (particularly SMBs who receive the worst credit card rates around), the fees aren’t likely to trend downward any time soon.

Having Kids

Paul Graham, the founder of YCombinator, on having kids. A lot of what he discusses in this essay resonates. A worthwhile read for any parent, soon to be parent, or potential parent. My favorite part copied below.

What I didn’t notice, because they tend to be much quieter, were all the great moments parents had with kids. People don’t talk about these much — the magic is hard to put into words, and all other parents know about them anyway — but one of the great things about having kids is that there are so many times when you feel there is nowhere else you’d rather be, and nothing else you’d rather be doing. You don’t have to be doing anything special. You could just be going somewhere together, or putting them to bed, or pushing them on the swings at the park. But you wouldn’t trade these moments for anything. One doesn’t tend to associate kids with peace, but that’s what you feel. You don’t need to look any further than where you are right now.

The Influencer and the Hit Man: How a Years-Long Domain Name Feud Ended in a Bloody Shootout

The journey to becoming an influencer can be long and arduous, with people going to incredible lengths to capture their 15 minutes of fame. A critical component to online fame is a name. That name is the center of a brand. Getting the same one across multiple platforms - Facebook, Instagram, TikTok, Twitter - is critical. Also important, but not as critical, is the good, old fashioned URLs. This piece follows the crazy story about how one supposed influencer attempted to get the final jewel for his online presence. A few snippets below.

Adams wanted the URL DoItForState.com in particular to complete his brand. Maybe it was a desire to take advantage of every financial opportunity available to him, or an inherent need to own every aspect of the company he had created. For whatever reason, the domain name, one of the most old-school digital properties out there, became a point of fixation. Eventually, it would also be Adams’ Achilles’ heel.

Over the course of several conversations, a plan emerged: Hopkins would break into Ethan Deyo’s house and force him to transfer the domain to Adams.

Hopkins peeked through a window of Deyo’s house, saw Deyo on the first floor, and then proceeded to break in through the back door. By the time he got in, Deyo must have climbed to the second floor already, and what happened next was a blur: Deyo barricading himself in the upstairs bedroom, Hopkins running up the stairs after him, busting through the door, and leading him by gunpoint into the office.

Naturally, 2019 Closes with Thousands of 10-Inch Pulsing “Penis Fish” Stranded on a California Beach

You could be forgiven for being offended by the above photo: thousands of 10-inch wiggly pink sausages strewn about Drakes Beach. The same phenomenon has been reported over the years at Pajaro Dunes, Moss Landing, Bodega Bay, and Princeton Harbor. I’ve heard my share of imaginative theories from beachcombers, such as flotsam of a wrecked bratwurst freighter. In truth, these are living denizens of our beaches rudely, yet also mercifully, mostly called “fat innkeeper worms.”

Presented and left without comment. Just a whole lot of 🤣

Yikes!

Quote I’m thinking about: ”The best way to keep a prisoner from escaping is to make sure he never knows he’s in prison.“ - Fyodor Dostoevsky