Rishi Taparia - Issue #77

This week we look at the monster merger between Fiserv and First Data, Home Depot’s effort to create a single customer experience, Visa and Mastercard given the cold shoulder by the Chinese Central Bank, China’s scientific superpower ambitions, Bill Gates on the best investment he’s ever made and more. Enjoy!

Starting with...

fiserData: A behemoth is born, but is it enough?

This week a financial powerhouse was born as Fiserv agreed to buy First Data for $22 billion in an all stock deal. The news comes as a surprise for many in an industry that doesn’t see transactions of this size very often. The combined company (which will go by Fiserv in a tragic waste of an opportunity to rebrand) forges a mammoth technology vendor attempting to prove that despite all the noise around young tech companies like Square and Stripe, old dogs can also learn new tricks. The big question is whether it is too little too late.

Talk about missed rebranding opportunity.

The clear winner in the near term is Fiserv. A major technology vendor on the issuing and payments side, underlying 140 million checking accounts and over 30 billion digital payment transactions, Fiserv is cannonballing into merchant acquiring on global scale. With pro forma revenue over double that of their biggest competitor FIS, Fiserv also now has access to the 4,000 First Data customers, mostly the long tail of banks and small financial institutions current outside of Fiserv’s core customer base, to sell to and pull away even further. The deal provides a clear path for international expansion, near term revenue growth and higher EBITDA which the Street will reward them for.

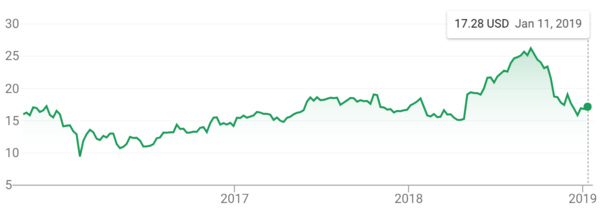

For First Data this is a capitulatory move, submitting to the very real challenges of running an acquiring business that is becoming increasingly commoditized. Saddled with debt after getting taken out by KKR over a decade ago, the stock gained under 10% in the more than three years since the IPO in 2015 despite the company being the largest global merchant acquirer, processing over 93 billion transactions annually. With First Data still the largest investment on KKRs balance sheet (the PE firm still maintained a 39% stake in the business post IPO), they finally seem to have agreed that the best path forward is within another organization — the end of a rocky journey that included numerous acquisitions in an effort to further innovate on top of a monster acquiring business. KKR will own 19% of the combined business.

Not a whole lot of movement for FDC. Source: Google Finance.

The short term challenge for Fiserv is now making sure this cannonball doesn’t turn into a belly flop. Integrating the two businesses — a combined 48,000 employees with very distinct cultures and skeletons — is an undertaking of massive proportion that will certainly be a major distraction and likely throw a wrench into any previously planned 2019 initiatives.

Following integration, the next and more important challenge will be product development. Tech first players like Square, Stripe, Adyen, Ant Financial and Tencent have fundamentally changed the financial services landscape, making good design and user-first product experiences table stakes. Despite processing a fraction of the amount of First Data and making less than 30% of the revenue of Fiserv, Square’s market cap was over 40% higher than First Data’s and only slightly less than Fiserv’s prior to the merger announcement. Stripe’s most recent valuation puts them just shy of where First Data is trading, and that’s despite having leveraged FDCs infrastructure for the majority of their time as a company! The market (both customers and investors) now demand continued innovation, leading from the front instead of attempting to follow fast which is the safe zone for banks. Focusing on product is going to be key to long term survival and attracting investors. To their credit, Fiserv announced they are going to be investing $500 million for incremental innovation. However, based on its current allocation —technology like digital enablement, next generation merchant solutions, advanced risk management, data focused solutions and ecommerce — I doubt $500 million is going to be enough.

As for the rest of the market this should serve as a warning — time to go big or go home. FIS is surely paying attention and likely contemplating a move of their own. Based on the common path legacy businesses have been taking — acquiring assets that help support the existing base instead of new market development — an acquisition of TSYS or even Worldpay by FIS is not out of the question. Not the move that’s going to be viewed as a real difference maker 10 years from now (better off trying to go buy Adyen or Stripe) but better than nothing I guess.

***

This post was originally shared on Medium.

Commerce

Home Depot Is Rehabbing The Shopper Experience. Can Other Retailers Do The Same?

One surprise of the holiday season is that home-improvement product sales rose 9%. Home Depot was likely a major contributor thanks to its five-year strategy to create an integrated “one-store” experience. This article is a good look at how the 40 year old retailer has upgraded their experience and how its upgrades could elevate shopper expectations for other brands.

In New York, a Glitzy New Mall Devotes a Floor to Online Retailers

Developers of a glitzy new Manhattan shopping center think they have found a way to cash in on the surge in e-commerce: stock a floor with companies that began as online-only retailers. This follows a massive trend of going offline, but unlike other malls offering “100 to 300 square feet to each retailer, rotating among them with new brands every few months”, this is a major bet on a new kind of ‘anchor tenant’. If this experiment works, it could have a ripple effect around the country, opening up new opportunities for online retailers.

7 cool tech innovations from NRF

This week was the big NRF show, bringing thousands of people to New York for everything retail and commerce. Companies trotted out their wares and their plans for growth. A brief look at 7 cool innovations from the show:

Freshhippo checkout solutions

SmartPixels use 3D product visuals for interactive customer experiences

Tompkins Robotics is an automated, self-charging system that provides unit and parcel sorting

Pensa Systems using drones for scanning inventory

Compucom’s digital smart lockers for buy online pickup in store

Zippin’s cashierless shopping experience

Cineplex Digital Media utilizes screens to advertise to consumers, create connections to brands and obtain data

FinTech

Visa and Mastercard left out in cold as Chinese Central Bank refuses to process application

The Chinese central bank, after allowing American Express to operate in the country last year, have rejected both Visa and Mastercard’s applications that would have allowed the networks to operate in country and process renminbi. The best part - the applications themselves weren’t rejected, the Central Bank has simply ignored the fact that they were submitted in the first place. Talk about passive aggressive at a whole other level.

Fed Says Student Debt Has Hurt the U.S. Housing Market

The Federal Reserve came with one of the better “no duh” statements of the week: rising student debt has led to a drop in homeownership among young Americans. With over $1.5 trillion (with a T) in outstanding student debt (more than either credit cards or car loans), and more college grads migrating from rural areas into the more expensive city, “homeownership among people ages 24 to 32 fell 9 percentage points, to 36% from 45%, between 2005 and 2014, the Fed said.”

Kabbage Now Powering "Pay Later" Financing for Alibaba.com U.S. Customers

Alibaba took another step towards growing their US presence, announcing a partnership (not no investment…which I’m skeptical about) with alternative lending platform Kabbage this week. There is certainly more than meets the eye to this deal given Alibaba’s payment arm Ant Financial has a massive lending platform of its own that it was attempting to bring to the US, especially ahead of a project Ant Financial IPO over the next 12-18 months. My guess is increased regulatory scrutiny from the Trump administration towards Chinese companies has effectively handcuffed any moves that would be made here and so the company is executing plans C, D and E.

Technology

Can China become a scientific superpower? - The great experiment

A long read by the Economist on China’s science superpower ambitions. Long been considered replicative instead of innovative, the China is attempting to rebuild its image as a bastion of scientific discovery. There are quite a few challenges though.

A culture that provides the results the boss wants, or does not investigate inconvenient anomalies, or withholds data from nosy outsiders is not good enough.

But the idea that you can get either truly reliable science or truly great science in a political system that depends on a culture of unappealable authority is, as yet, unproven. Perhaps you can. Perhaps you cannot. And perhaps, in trying to do so, you will discover new ways of thinking as well as fruitful knowledge.

‘They Own the System’: Amazon Rewrites Book Industry by Marching Into Publishing

In a wild week for Amazon’s Jeff Bezos (I had to bring it up, how can you not?), I’m instead choosing to focus on the company’s dominance in publishing. The online retail giant unsurprisingly commands an unrivaled customer base for the books, ebooks and audiobooks. However, it may come as a surprise that they’re also a massive publisher, and as result, upending the industry by creating instant best sellers out of self-published writers.

Netflix is finally sharing (some of) its audience numbers for its TV shows and movies. Some of them are huge.

Netflix posted massive earnings this week with some jaw dropping numbers. Fun fact: Netflix now accounts for 10% of total TV time in the US. Other fun fact: Netflix is now reaching upwards of 40 million households for their most popular shows (which for context compares to 20 million for the most popular cable shows). The challenge is it’s hard to verify and validate the numbers since they are self reported but massive, no matter how you cut it. So big, that they’re comfortable raising the monthly fee across all subscription tiers.

Random Tidbits

Virginia Woolf? Snob! Richard Wright? Sexist! Dostoyevsky? Anti-Semite!

As time goes on cultures, sentiment and social norms evolve. The world is different place (thankfully so). That said, how should we read great literature from the past whose moral blind spots offend us? Brian Morton, director the writing program at Sarah Lawrence College makes the case that instead of “[imagining] an old book to be a time machine that brings the writer to us…we’d all be better readers if we realized that it isn’t the writer who’s the time traveler. It’s the reader. When we pick up an old novel, we’re not bringing the novelist into our world and deciding whether he or she is enlightened enough to belong here; we’re journeying into the novelist’s world and taking a look around.”

Bill Gates: The Best Investment I’ve Ever Made

I’ve previously said that Bill Gates will be remembered more for his philanthropic work than founding Microsoft. He certainly seems to think so as well. In this op-ed for the WSJ, the billionaire makes an encouraging argument to help fund global-health groups that buy and distribute medicines - a sure bet for saving lives, but with government funding is now in danger, they need help.

New App Helps People Remember Faces

Shazam for people. It would make life so easy, particularly at dinner parties, conferences and those awkward moments you see someone walking down the street and know you know them but don’t quite know how. Well, it turns out this now exists. The major problem - should it?

The app, called SocialRecall, connects names with faces via smartphone cameras and facial recognition, potentially eliminating the need for formal introductions. “It breaks down these social barriers we all have in terms of initiating the protocol to meet somebody,” says Barry Sandrew, whose start-up, also called SocialRecall, created the app and tested it at an event attended by about 1,000 people.

Quote I’m thinking about: “The more scared we are of a work or calling, the more sure we can be that we have to do it.” - Steven Pressfield, The War of Art