Rishi Taparia - Issue #43

This week we look at Adobe’s shopping cart, American banks’ view of Ant Financial and Tencent, Adyen’s quiet rise, lackluster mobile payments adoption in the US, Go-Jek’s expansion plans and more. Enjoy!

Commerce

Adobe Buys Magento for $1.68 Billion to Target E-Commerce

The battle for the ecommerce stack intensified this week as Adobe announced plans to purchase Magento for $1.6bn. Having spun out of eBay in 2005 by private equity firm Permira, the sale represents what a likely 5x return for the fund in an increasingly competitive space with players like Shopify (who’s stock took a 5.5% dip on the news) offering an increasing array of solutions to merchants. BigCommerce seems to be the last somewhat large private player standing in the space, I wouldn’t be surprised to see a few bids for them come in over the coming months.

J.C. Penney CEO Marvin Ellison resigns to join Lowe's as CEO

An interesting move by Lowe’s to bring in the JC Penny CEO as the new chief. A move that is easily sold to shareholders (, don’t get me wrong, Marvin Ellison has all the creds) but is safe really what shareholders need? Has JCP under Ellison displayed the characteristics of a business Lowe’s is trying to emulate? It seems to me that the Ron Johnson failed experiment at JCP enough to cause traditional retailers not to stray too far outside the pack (although I’d argue this is the wrong lesson to be taking from Johnson’s tenure at JCP).

Visa, Mastercard Push for One-Click Ordering. Retailers Say ‘Not So Fast’

Networks try and come up with a new checkout method. Retailers say “Thanks but no thanks.” Representatives of large retailers including Walmart and Home Depot met with federal regulators this week to raise concerns about a new online payment initiative that Visa and Mastercard are preparing to roll out that, according to retailers, will limit the ability to route transactions over the cheaper debit rails.

FinTech

Why China’s Payment Apps Give U.S. Bankers Nightmares

This article offers a good high level breakdown of the difference in payments infrastructure in US (developed markets) versus China (and other emerging markets). As I’ve discussed here before, the lack of traditional banking infrastructure, coupled with the rise of mobile devices, created a once in a generation opportunity for companies like Ant Financial and WeChat to fundamentally change the way consumers think of payments and the institutions they put their trust in to successfully carry out these transactions. In doing so, they have also turned the revenue model on its head, accelerating the march towards zero margin in payments processing, the real value being in the data behind transactions.

One gripe I have with the piece, however, is it refers to Ant Financial and WeChat as “apps”, suggesting a level of simplicity or ease. This severely diminishes the scale and scope of two companies that have transformed into financial behemoths that are shaping the future of payments and commerce as we know it. The author concludes that “U.S. banks have formidable advantages on their home turf…longstanding relationships with their customers, many of whom still like ‘visiting their money’ at a local branch, credit card rewards programs and other perks.” While these advantages certainly exist, the fact that banks aren’t pressing these advantages, instead trying to create their own QR code standards, should illustrate exactly who has leverage. The idea that Amazon or Apple could do what WeChat and Ant are doing in China here locally is certainly making bankers quite uncomfortable.

All the mouths that credit cards feed

Adyen confirms an IPO in Amsterdam, valuing the payments giant at $7B-$11B

Adyen is one of those payment companies that, for those of us in the US, has flown relatively under the radar while building itself into a major player. Now making major waves after winning eBay’s business away from PayPal (in what was a head to head to head battle against both PayPal and Stripe), this is a company that, relative to other players in the market, just knows how to get it done when it comes to payments. Based in Amsterdam, the company filed to go public on the Euronext Amsterdam exchange, choosing to stay close to home as opposed to listing on the more well known US exchanges. Certainly one to watch in my book.

The surprising company beating Apple and Google in mobile payments

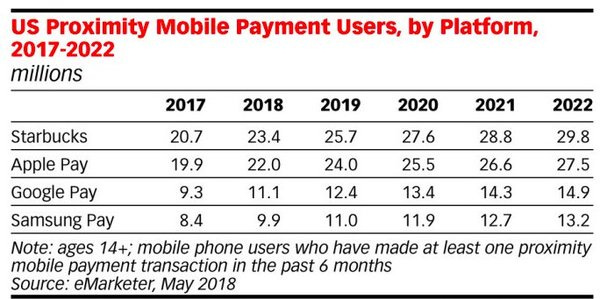

A lot was made of the news this week that Starbucks was beating out both Apple and Google when it comes to mobile payments. I don’t believe that this news should have surprised anyone. Starbucks has a daily use case with the relevant technology in all their stores that guarantee acceptance, compared to the NFC based payment methods put forth by Apple and Google that aren’t universally accepted and, compared to a card swipe, are still more complicated. However, I do think the chart below will turn out to be wildly off in the out years. As NFC enabled terminals become the norm, consumer EMV adoption gets to 75%+ and lines slow down, I believe Apple Pay and Google Pay become the better experience that result in more usage. This will have them well outpacing Starbucks when it comes to usage (there are simply more things people buy than Starbucks coffee).

Noticeably absent (for now): Alipay and WeChat Pay

Making Sense of Mortgages: The Problem, and the Opportunity

This piece by the team over at Andreessen Horowitz does a great job describing one of the oldest forms of lending in the world - the mortgage or the ““death pledge” in Latin”. It outlines the system as it currently exists, some of the structural issues with the existing system and opportunities for companies to improve the structure.

Technology

Indonesia's Go-Jek announces $500 million expansion

Break out the popcorn, the ride hailing battles that I’ve discussed here before just got a lot more interesting. Indonesian unicorn Go-Jek, on the back of a $1.5bn fundraise, announced this week that they are taking that money and going traveling. The company plans on spending $500m to expand into 4 additional markets - Singapore, the Philippines, Vietnam and Thailand - the expansion set to further heat up the rivalry with Singapore-based Grab (who, as you may recall, recently bought Uber’s business in Southeast Asia). And, in case you forgot, Grab is backed by Softbank (major backers of Alibaba and Ant Financial) while Go-Jek is backed by Tencent (maker of WeChat Pay). A fun game of chess being played at many levels.

112: Deconstructing Google Duplex, with Brian Roemmele

Google Duplex shocked the tech world a few weeks ago, kicking off a conversation on ethics and the future of voice assistants. This podcast between Rene Ritchie and Brian Roemmele (who has been talking about voice for decades) was interesting to me, bringing to light some arguments around how to solve the ‘ownership’ problem of voice bots that I hadn’t previously considered.

Random Tidbits

Quote I’m thinking about: “Genius is a Latin word; the Romans used it to denote an inner spirit, holy and inviolable, which watches over us, guiding us to our calling. A writer writes with his genius; an artist paints with hers; everyone who creates operates from this sacramental center. It is our soul’s seat, the vessel that holds our being-in-potential, our star’s beacon and Polaris.” - Steven Pressfield, The War of Art