Rishi Taparia - Issue #29

This week we explore malls and the future of American retail (with thanks to Yelp), Instacart continues to kick ass, WeWork begins executing on a non-coworking strategy, Glamglow shows how to market on social, consumer debt numbers are released (and they are concerning), Amazon shows lending is hard and more. Enjoy!

Commerce

Malls and the future of American retail

There is quite a bit of noise being made these days around the idea that brick and mortar retail is dying, only to be replaced by digital driven commerce. As I’ve discussed here previously, and as the subhead so rightly points out, it’s not that bricks and mortar is out of fashion; bad customer experience is out of fashion. A well researched long read on how malls are beginning to transform themselves with the aim of creating a new kind of space.

Is America in a Retail Apocalypse? Ask Yelp

Don’t let the previous comment fool you, retailers are shutting down faster than ever before. An interesting source of data - Yelp reviews. Like Foursquare, Yelp has become a treasure trove of data on merchants and openings / closings (PSA: the ‘Hot and New’ filter in Yelp is your friend…thank me later).

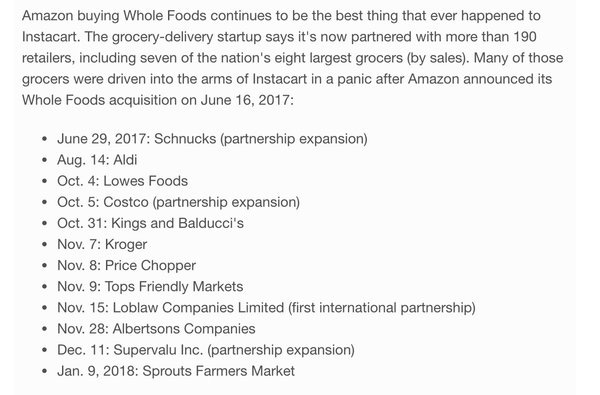

Instacart Adds $200 Million to Defend Against Amazon Delivery

I was wrong on this one, and credit is owned where credit is due. When Amazon bought Whole Foods, Instacart’s largest partner and source of new customer leads, I thought the company was in for a rough ride. My mistake was forgetting just how scared other retailers are of Amazon and why that fear would make Instacart a natural partner to combat them.

Talk about the enemy of my enemy is my friend

WeWork moves into retail with new partnership with J.Crew

J.Crew partners with WeWork to do a series of panel discussion series at select WeWork locations is the headline. The reality is these venues will also sell merchandise from J.Crew’s spring collection at pop-up shops that offer discounts to WeWork members. A not altogether surprising partnership that brings together a struggling retailer with a startup justifying its $20bn valuation by saying the space they have can be used to much more than co-working.

How Glamglow became the skin-care brand with the most buzz on social media

The first thing I did when I read this was text my wife, “Have you heard of Glamglow?” “Yup, amazing product.” An interesting piece that, while it focuses on a single brand and their growth, has some lessons that are broadly applicable and will likely be further leveraged as brands continue to realize traditional marketing strategies are not as compelling to buyers as they once were. Influencers, YouTube content, local targeting with Instagram and targeted giveaways, while seemingly obvious, all have unique parts to play in crafting a narrative that is value additive.

FinTech

Americans Can’t Get Enough Consumer Debt

US consumer debt (non-mortgage) now sits at $3.8tn, the highest amount ever recorded, with an average of 5.8% of income used to pay down debt. With delinquencies on the rise, particularly in student loans, and the market fluctuations that have taken place over the last few weeks, I grow increasingly concerned that we are heading towards an economic reset. There are obvious counters (low unemployment rates, wage growth) but a dangerous concoction is brewing.

Zelle users are finding out the hard way there’s no fraud protection

Banks are finding out it takes more than paying a bunch of money for a third party to build and marketing an app to build a reliable P2P payments system. Scammers have taken to Zelle, the Venmo alternative backed by U.S. banks, to defraud consumers who believe the service includes the same protections they’ve come to expect from companies like PayPal and Venmo. Unfortunate, and a bit surprising considering banks themselves are among the most conservative companies out there.

Amazon teams with Bank of America for lendtech leap

Lending is hard, even for a company like Amazon. After rolling out a merchant lending solution in 2011, the company has partnered with Bank of America to expand the program. According to Amazon’s annual report published earlier this month, Amazon Lending hasn’t had a lot of growth of late. It almost doubled to $661 million in 2016, but last year outstanding loans increased to $692 million. Not a huge leap. Maybe working with a bank for capital will make it easier?

What To Know About Visa's New Chargeback Rules

Chargebacks are an increasingly growing problem as card penetration continues to go up and EMV adoption stagnates a bit. On April 15, Visa will introduce new rules for handling disputes that are intended to simplify the process from a litigation-based model to a liability assignment model based on solid data surrounding the claim.

Technology

Inside Facebook's Hellish Two Years—and Mark Zuckerberg's Struggle to Fix it All

A LONG but worthwhile read on 2 years of struggle at Facebook as the social networking giant expands into arenas they didn’t even see coming. Well worth the time, particularly considering the Wired reporters got 50 FB insiders to talk to them.

Disney: Alibaba will stream its movies and series in China

The wonderful world of Disney is growing beyond the physical and into the digital. Disney and Alibaba has signed a deal to steam over 1,000 Disney movies and TV episodes to Chinese users. A big deal to be sure, particularly given Netflix admitted defeat in 2016 after failing to launch in the market, being forced to license shows through a Chinese company (iQIYI which happens to be a subsidiary of Baidu). As I have often said, China and Chinese companies are playing a game of 4-d chess, and the behemoths are growing their reach in a variety of ways.

Random Tidbits

The American Mall Game: A 2018 Retail ChallengeAmerican Mall

A fun, 1908s style game by Bloomberg that has you build and manage a mall. Good luck to you!