Rishi Taparia - Issue #10

This week has Instagram building a potentially dominant ecommerce platform, Starbucks going old school and shutting down their online store, more crazy mobile payment numbers out of China, Softbank’s world changing investment strategy, the beginning of the end for social security numbers and more!

Commerce

Instagram opens its shoppable posts feature to retailers on Bigcommerce’s platform

Instagram is opening up their ‘shoppable posts’ to third parties, enabling users to directly buy from the app. A natural extension of their platform given the amazing following brands and instagram celebrities have, I’m surprised it took so long. This is long what I thought Pinterest would enable but they haven’t seemingly executed on it.

Shake Shack is launching a cashless burger joint in NYC

I’ll take a cheeseburger, bacon, no onions, hold the cash. The iconic burger joint is going cashless, and potentially attendant-less as ordering will now be done via kiosk. Let’s see if cashless catches on - you’ll know when you can pay for chicken rice with a credit card.

Starbucks Closes Online Store to Focus on In-Person Experience

One of the world’s biggest brands just said, “Bye Felicia!” to their online store, optimizing for the in-store experience instead. This forces Starbucks lovers around the world to get off their couches and walk to the closest location to get the required ingredient to make the grande pumpkin spice latte. An interesting and calculated move to be sure. Expect to see some improvements and enhancements to the in-store experience.

Mall owners reject the notion of a retail apocalypse

Three top mall CEOs met with reporters in New York last week to dispel what they call the exaggerated stories about the demise of their industry. There must be an area in the mall where they serve special water because clearly all is not well in retail land. Their argument is that there is more smoke that there is fire considering eCommerce accounts for less than 10% of all sales and consumers are “…stuck with [malls].” The macro trends aren’t in their favor, but the value of the store in a retail experience is there - it just needs to be reimagined to fit a world where online and offline are not distinct experiences.

Costco delivery options vs. Amazon

Costco vs. Amazon is has found new battlegrounds - online delivery and a partnership with Instacart for same day delivery in a classic “the enemy of my enemy is my friend” deal.

FinTech

China's third-party mobile payment market continues rapid expansion

As a follow up to the above article, Q2'17 mobile payment numbers were released. Headline: they’re absurd. Q2 saw $3.5 trillion dollars of mobile payment transaction volume which is up 22.5 percent (!!!) from the previous quarter.

1.4 billion touchscreens can't be wrong: Chinese mobile-pay culture takes great leap

While rural Americans struggle to keep their cell service, Chinese consumers have evolved from a cash-only economy to managing their whole lives through a smartphone.

EMV at Two: Consumers Still Think Purchases Are Too Slow; Many Merchants Indifferent

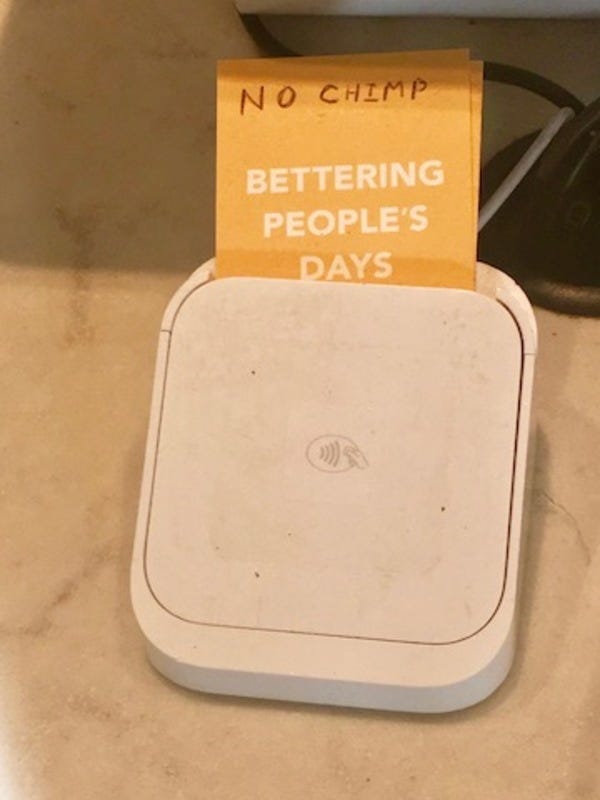

Chip and meh? It’s been two years since EMV hit the US and the rollout has been lukewarm at best. Transaction times on most terminals are too long (one estimate put the cost at 116 hours wasted), too many consumers still don’t know how to insert the card and devices still aren’t certified. A lot of merchants are now saying “bring on the liability!”

No chip, or chimps, allowed.

Technology

SoftBank Plots Deals to Build $300 Billion Asset-Management Arm

You know what’s better than a $100bn Vision Fund? A $300bn Vision Fund. SoftBank founder Masayoshi Son made a name for himself building a telecommunications and technology empire. He’s now expanding VERY aggressively in asset management. Deploying $300bn over any kind of time frame that yields a reasonable IRR aside, this vision (pun intended) puts Softbank in the middle of any financing conversation and will likely have them investing in literal moon shots.

India's Ola Raises $2 Billion From SoftBank, Tencent

Speaking of Vision Fund, Ola, India’s largest ride sharing company and major Uber rival, scored $2 billion in new funding from a group of investors including SoftBank and Tencent Holdings, an interesting considering pairing considering SoftBank’s deep ties to Alibaba, but that’s for another day. Also interesting given SoftBank’s bid to invest in Uber, and the fact that they have invested in Grab in Southeast Asia, 99 in Brazil and Didi Chuxing in China. I guess what you can do with $100bn and counting - invest in all the major players and when consolidation starts, have a meaningful stake in the winner, regardless of who it is. VC as a platform?

Facebook's VP of Product on Mastering Focus and Intentional Work

Facebook VP of Product Fidji Simo shares tactics to master focus in a world where possibilities are endless and the stakes are high. A tremendous piece that everyone can find benefit from.

Random Tidbits

White House wants to end Social Security numbers as a national ID

The Equifax breach has prompted a renewed discussion on identity and social security numbers. It seems the US government is finally on board, purporting to be examining the use of a “modern cryptographic identifier” in lieu of the traditional SSN.